Financial Machine Learning is a field pioneered by Bryan Kelly, blending finance and advanced machine learning techniques. Kelly’s work leverages big data to enhance financial modeling and prediction.

Financial Machine Learning is an innovative area at the intersection of two dynamic fields: finance and machine learning. Bryan Kelly, a renowned researcher, has been instrumental in advancing this discipline, which focuses on developing predictive models and algorithms that can uncover complex patterns in large financial datasets.

This approach has revolutionized the way financial markets are analyzed, offering more accurate forecasts and risk assessments. By applying machine learning tools, finance professionals can now process and interpret vast amounts of data more efficiently than ever before. Kelly’s contributions have made significant strides in algorithmic trading, portfolio management, and risk control, establishing new standards for data-driven decision-making in finance.

Introduction To Financial Machine Learning

Financial machine learning is a rapidly growing field. It combines finance with powerful machine learning techniques. These techniques help in predicting market trends. They also assist in automating trading decisions. This integration offers insights that can lead to better financial strategies.

The Rise Of Machine Learning In Finance

Machine learning is transforming the finance industry. It is doing so at an impressive pace. Financial institutions are now relying on algorithms. These algorithms are smart. They learn from data. They improve over time. Key areas of impact include:

- Risk assessment

- Investment prediction

- Fraud detection

- Customer service automation

Advanced technologies give financial experts new tools. With these tools, they are creating innovative solutions. These solutions help in making better-informed decisions.

Who Is Bryan Kelly And His Contribution

Bryan Kelly is a name synonymous with financial machine learning. His research stands out. He is a professor of finance. Not just that, he’s also a machine learning innovator. His work bridges the gap between academia and the finance industry.

Dr. Kelly has made substantial contributions. Here are some highlights:

| Contribution | Impact |

|---|---|

| Research on Asset Pricing | Understanding market patterns better |

| Developing Machine Learning Methods | Improving investment strategies |

| Educational Initiatives | Training the next generation of financial analysts |

His contributions are numerous. They have a significant impact on how financial markets operate today. Noteworthy, his guidance is shaping a new era of data-driven finance.

Key Insights From Bryan Kelly’s Research

Understanding financial trends is like predicting the weather in a storm. Bryan Kelly, a wizard in Financial Machine Learning, helps cut through the chaos. His work shines a light on how computers can predict market trends. Let’s dive into his key insights.

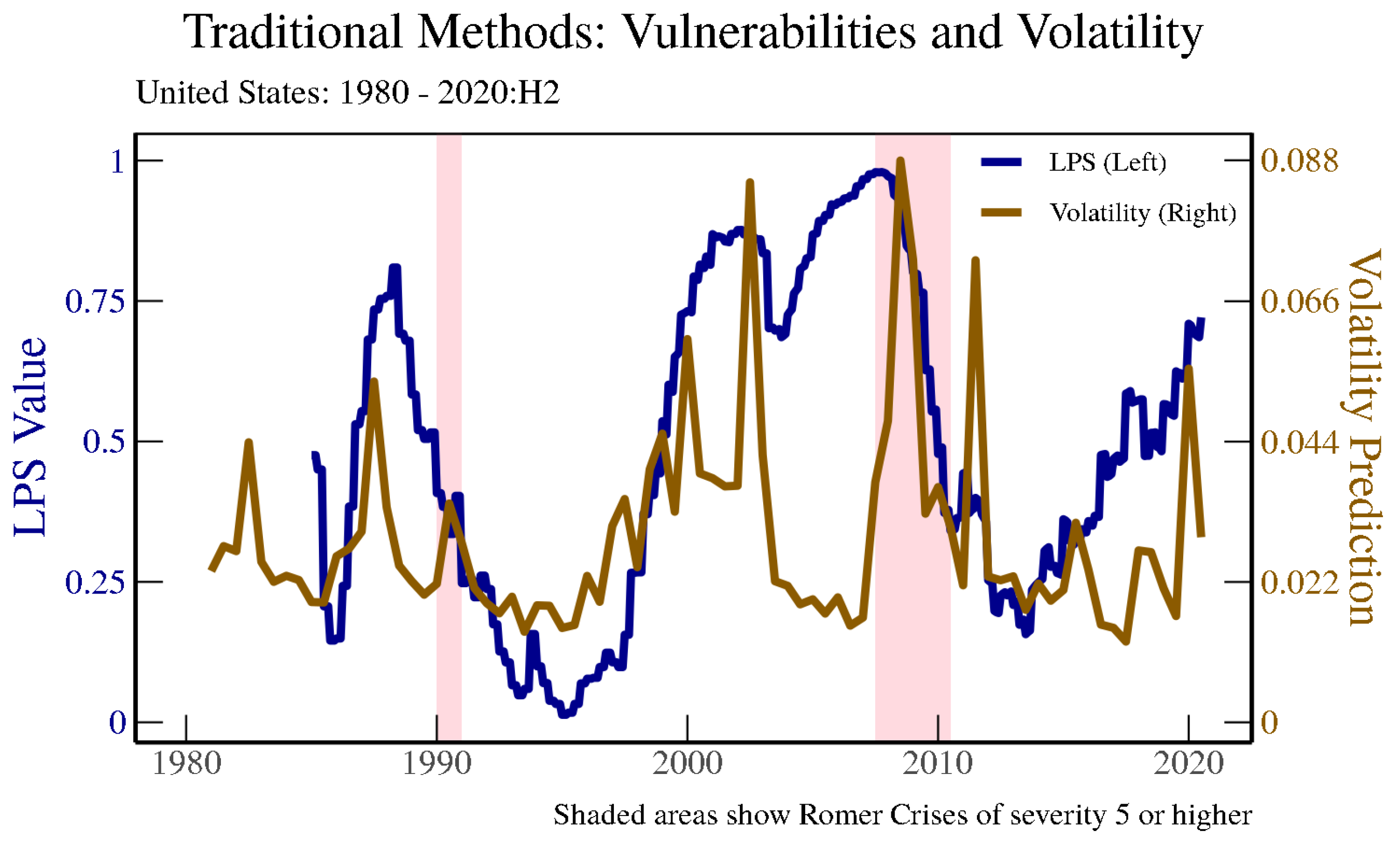

Advancements In Predictive Modeling

Bryan Kelly’s research has pushed forward the boundaries of predictive modeling. He uses big data and machine learning to see into the market’s future. His methods help investors make smarter choices, by predicting stock performances.

- Deep learning helps understand complex patterns.

- Quantitative methods merge with economic theory for better forecasts.

- Technology now spots trends faster than any human.

Risk Assessment And Portfolio Management

Investing is tricky; the risk is always lurking. Kelly’s research guides investors in managing this. His work in risk assessment makes investing safer.

His portfolio management strategies combine risk with potential gains. Investors can see what’s risky or promising. Kelly’s models provide a roadmap for investment choices.

| Aspect | Impact |

|---|---|

| Machine Learning Tools | Enhanced accuracy in risk prediction |

| Portfolio Optimization | Better balance of risk and reward |

Machine Learning Techniques In Finance

Finance sectors worldwide are rapidly embracing machine learning. Experts like Bryan Kelly highlight the potential for these advanced algorithms to transform the industry. From analyzing market trends to managing financial risks, machine learning introduces innovative solutions for complex financial tasks. Let’s delve into the specific techniques that are reshaping finance.

Supervised Vs. Unsupervised Learning

Machine learning in finance hinges on two key strategies: supervised and unsupervised learning.

- Supervised Learning: This approach uses historical data to predict future events. Financial models learn from past trends to forecast stock prices or credit scores.

- Unsupervised Learning: Unlike its counterpart, unsupervised learning detects patterns without predefined outcomes. It excels in identifying customer segments or detecting fraudulent behavior.

Time Series Analysis And Anomaly Detection

Bryan Kelly emphasizes the significance of time series analysis for financial predictions. Time series analysis helps lenders understand market fluctuations over time. Machine learning models process this data, making sense of complex patterns.

Part of this analysis includes anomaly detection. Algorithms quickly identify unusual transactions that could indicate fraud. Such rapid detection safeguards finances and ensures customer trust.

Credit: www.gensler.com

Real-world Applications

Financial Machine Learning is changing the game. Experts like Bryan Kelly show us its power. It spots trends and protects our money. Let’s explore the real-world uses of this smart tech.

Algorithmic Trading

Stock markets now lean on smart machines. Quick decisions make or break fortunes. Bryan Kelly’s insights fuel these trading bots. They learn from tons of data. They buy and sell at the best times. Here’s how they help:

- They scan markets for price changes.

- They predict stock movements, fast.

- They execute trades quicker than humans.

Fraud Detection And Prevention

Fraud hits hard. It steals from people and companies. Machine learning comes to the rescue. It spots fraud patterns and waves red flags. It’s like a smart guard for your finances. Here’s what it does:

- Watches for strange account behavior.

- Alerts banks of unusual transactions.

- Keeps criminals away from your cash.

Challenges And Ethical Considerations

Finance and technology fuse in exciting ways, but not without hurdles. Machine learning plays a big role in analyzing data to predict market trends and make investment decisions. Yet, this brings unique challenges and ethical concerns. Data privacy, security, and bias are vital. We’ll look into how these issues impact financial machine learning.

Data Privacy And Security

People worry about their personal data. Financial machine learning often uses huge amounts of sensitive information. Keeping this data safe is a top concern. Here we explore why securing data is hard and what steps we can take to keep private details safe.

- Hacking risks: Data breaches can lead to huge losses.

- Data misuse: Even with consent, misuse is an issue.

- Regulation compliance: Laws govern data use and require strict adherence.

Bias And Decision Accountability

Machine learning models might not be fair to everyone. They can reflect human biases. This can lead to unfair decisions that affect people’s finances. Let’s discuss how we can spot these biases and make those using these tools accountable for their decisions.

- Identifying biases: Check for patterns that may show bias in data sets.

- Auditing algorithms: Regular reviews can spot unfair processes.

- Clear accountability: Make sure there is a responsible party for every decision.

Credit: pubs.acs.org

The Future Of Financial Machine Learning

The domain of financial machine learning is a dynamic field. Innovations by thinking machines are quickly changing how we understand finance. Scholars like Bryan Kelly bring novel ideas to life. They help predict complex market behaviors with data and algorithms. Firms using these tools are gaining a competitive edge. This post dives into what tomorrow holds for this exciting industry.

Emerging Trends And Technologies

Financial machine learning is continuously evolving. New trends and tech reshape how traders and analysts operate.

- Artificial intelligence (AI) makes big data crunching simpler.

- Increased automation faces repetitive tasks, freeing up human talent.

- Deep learning uncovers hidden market patterns for better decision-making.

- Machine learning algorithms now adapt to new financial landscapes.

Blockchain and distributed ledger technologies also enter the mix. They promise to offer secure and transparent platforms for financial transactions.

Preparing For The Next Wave Of Innovations

To stay ahead, preparation for upcoming changes is crucial.

- Embracing new skills in data science and AI is vital for finance professionals.

- Innovative leadership is needed to drive technological adoption.

- Regulatory compliance must keep pace with tech advancements.

Partnerships between fintech startups and traditional firms will foster collaborative growth. Together, they can explore potential of financial machine learning.

Credit: www.mdpi.com

Frequently Asked Questions For Financial Machine Learning Bryan Kelly

Who Is Bryan Kelly In Fintech?

Bryan Kelly is a renowned expert and scholar in the intersection of finance and machine learning. His research focuses on applying cutting-edge computational methods to financial modeling, contributing to advancements in FinTech.

What Is Financial Machine Learning?

Financial Machine Learning combines computational algorithms and statistical methods to analyze financial data. The goal is to uncover patterns and make predictions, improving decision-making in finance.

How Does Machine Learning Impact Finance?

Machine Learning transforms finance by automating analyses, detecting fraud, optimizing portfolios, and personalizing financial services. It enhances predictive accuracy and operational efficiency in the financial industry.

Can Machine Learning Predict Stock Prices?

While Machine Learning can’t predict stock prices with certainty, it can analyze vast datasets to identify potential trends and factors influencing stock movements, providing insights for investors.

Conclusion

Embracing the insights of financial machine learning is vital in modern finance. Bryan Kelly’s work unveils how data-driven techniques enhance decision-making. By leveraging these innovative tools, investors and analysts can navigate the complex financial landscape with greater precision. Stay ahead by integrating these strategies into your financial practices now.