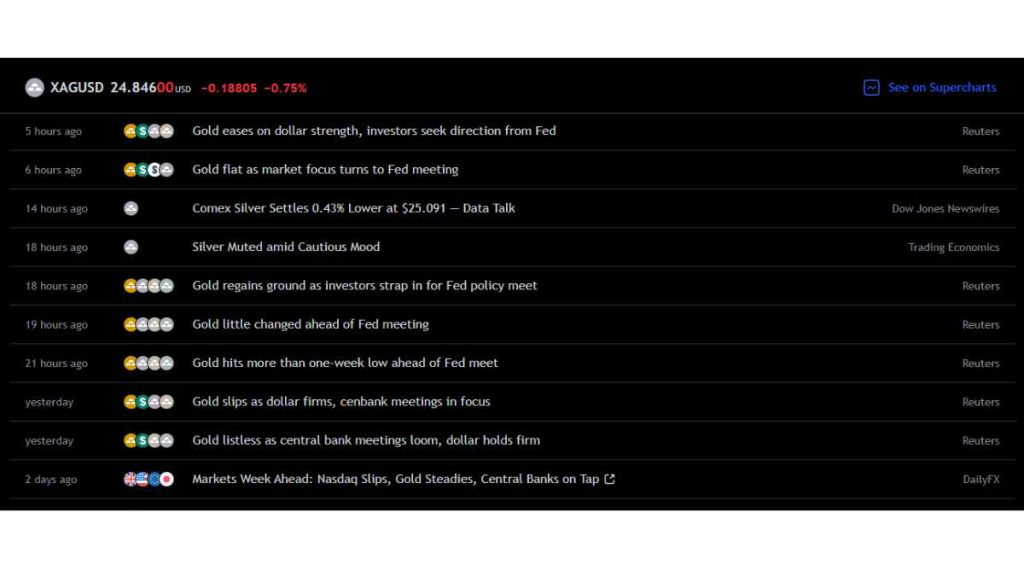

The Silver Price Fintechzoom is updated regularly. Stay informed about the latest silver prices.

Investors often turn to Fintechzoom for the most up-to-date information on the silver market. The platform provides real-time data and insights, allowing investors to make informed decisions about buying or selling silver. With fluctuations in the market, staying informed is crucial for maximizing returns and minimizing risks.

Whether you are a seasoned investor or new to the world of silver trading, having access to accurate and current silver prices is essential. Fintechzoom serves as a reliable resource for all your silver price needs, helping you navigate the complexities of the market with ease.

Factors Driving The Increase

Factors Driving the Increase:

The increase in silver prices is influenced by several key factors. Among these are the demand in industrial applications and the investment outlook.

Industrial Applications

Silver’s Value in Industries:

Silver is highly valued in various industrial applications, such as electronics, photovoltaic cells, and healthcare equipment.

Its conductivity and antibacterial properties make it essential in manufacturing processes.

Investment Outlook

Positive Investment Climate:

The investment outlook for silver remains positive due to its role as a hedge against inflation and market volatility.

Investors are turning to silver as a safe haven asset in uncertain economic times.

Impact Of Covid-19

The impact of COVID-19 led to fluctuations in the silver price. Fintechzoom reports revealed a shift in investor behavior towards precious metals due to economic uncertainties. As the pandemic unfolded, silver emerged as a popular choice for investors seeking stability in volatile markets.

Supply Chain Disruptions

The pandemic led to significant disruptions in the silver supply chain, impacting production and distribution.

- Lockdowns and restrictions hindered mining operations worldwide.

- Transportation challenges resulted in delays in delivering silver to refineries.

- The reduced workforce caused productivity issues in processing and minting silver products.

Inflation Hedging

Silver emerged as a popular choice for investors seeking to hedge against inflation during the pandemic.

- Investors turn to silver to preserve the value of their assets amidst economic uncertainties.

- Rising inflation concerns have boosted the demand for tangible assets like silver.

- Silver’s intrinsic value as a precious metal makes it an attractive inflation hedge option.

Silver Vs. Other Precious Metals

Explore the factors driving Silver Price Fintechzoom and its comparison with other precious metals like gold and platinum. Silver stands out for its versatility and wide industrial applications, making it a popular choice for investors seeking diversification in their portfolios.

Gold

Gold has long been revered as a safe haven investment and a symbol of wealth and stability. Its rich history and inherent value make it a sought-after precious metal. Unlike silver, gold is often seen as a store of value and a hedge against inflation. This means that during times of economic uncertainty, many investors turn to gold for its stability. It is also widely used in various industries, including jewelry, electronics, and even dentistry, further boosting its demand and price.

Platinum

Platinum, often referred to as the “rich man’s silver,” is one of the rarest precious metals. Its scarcity and unique properties make it highly valuable in various industries, particularly automotive and chemical sectors. While its price may not be as high as gold, platinum is still considered a store of value and a safe investment option. The demand for platinum continues to rise, partially due to its usage in catalytic converters for vehicles and jewelry.

Palladium

Palladium, a lesser-known precious metal, has gained significant attention in recent years. Its price has soared, surpassing even that of gold. The primary driver of this surge is the increasing demand for palladium in the automotive industry. Palladium is used in catalytic converters for gasoline-powered vehicles, making it a crucial component in reducing harmful emissions. This high demand, coupled with limited supply, has led to a substantial increase in the metal’s price.

Despite being less recognized than gold or platinum, palladium has proven to be a profitable investment for those who caught onto its potential. In summary, while silver holds its own unique charm, comparing it to other precious metals highlights the distinct characteristics and demand dynamics in each market.

Gold remains the standard for stability and value, while platinum and palladium have secured their positions in industries like automotive and chemical. Understanding the differences between these precious metals can help investors make informed decisions and diversify their portfolios.

Key Players In The Silver Market

The silver market is influenced by various key players who contribute to shaping the industry. Understanding these key players can provide insights into the dynamics of the silver market and help investors and enthusiasts make informed decisions. Let’s delve into the roles of the significant players in the silver market.

Mining Companies

Mining companies play a crucial role in the silver market, as they are responsible for extracting silver from the earth’s crust. These companies utilize advanced technologies and employ skilled workers to carry out the mining process. The extracted silver is then processed and made available for distribution in various forms, such as bars, coins, or industrial materials.

Bullion Dealers

Bullion dealers serve as primary distributors of physical silver products. They facilitate the buying and selling of silver bars, coins, and other forms of bullion. These dealers often offer a wide range of products, catering to both individual investors and institutional buyers. By providing a platform for trading physical silver, bullion dealers play a vital role in connecting supply with demand in the market.

Fintech Companies

Fintech companies have revolutionized the silver market by introducing innovative platforms and technologies for trading and investing in silver. These companies leverage digital solutions to offer online trading platforms, investment apps, and other financial services related to silver. Through fintech, investors can access real-time market data, execute trades efficiently, and manage their silver portfolios with ease.

Investment Strategies

Silver Price Fintechzoom offers investment strategies tailored to the dynamics of the silver market. With a focus on using fintech innovations, these strategies aim to maximize returns and minimize risk for investors interested in the silver industry. Our platform provides up-to-date insights and tools for informed decision-making.

Investment Strategies When it comes to investing in silver, there are several viable options to consider. The investment strategies for silver can range from physical holdings to investing in mining stocks. Each strategy has its own pros and cons, and it’s important to understand the nuances of each approach to make informed decisions that align with your investment objectives.

Physical Silver Investing in physical silver, such as bullion or coins, is a tangible way to add silver to your investment portfolio. Owning physical silver can provide a sense of security and can act as a hedge against economic uncertainty. However, storing and insuring physical silver comes with its own set of costs and considerations. Silver ETFs Silver ETFs, or exchange-traded funds, offer investors a convenient way to gain exposure to the price of silver without having to physically own and store the metal.

:

ETFs can provide liquidity and diversification, making them an attractive option for many investors. However, it’s important to carefully research and compare the various silver ETFs available to ensure they align with your investment goals. Silver Mining Stocks Investing in silver mining stocks can provide indirect exposure to the price of silver while also offering the potential for capital appreciation through the success of the underlying mining companies.

However, the performance of mining stocks can be influenced by a wide range of factors, including operational risks and market conditions. In conclusion, when considering investment strategies for silver, it’s essential to evaluate your risk tolerance, investment horizon, and overall financial goals. By understanding the different options available, you can make well-informed decisions that align with your investment objectives.

Future Projections

As technology continues to advance and reshape various industries, its impact on the silver market cannot be overlooked. The growing demand for silver across different sectors, combined with market trends, paints an interesting future projection for this precious metal.

Technology’s Impact On Silver Demand

The rapid growth of technology has significantly influenced the demand for silver. With the increasing use of electronic devices such as smartphones, tablets, and laptops, silver has become a vital component in these gadgets. Its exceptional conductivity and durability make it an ideal material for circuit boards, connectors, and other electronic components.

Furthermore, the rise of renewable energy sources like solar panels has also contributed to the surge in silver demand. Due to its superior reflectivity and conductivity, silver plays a crucial role in the efficient functioning of photovoltaic cells. As the world aims to shift towards cleaner energy alternatives, the demand for silver is expected to further skyrocket.

Silver Market Trends

The silver market is subject to various trends that shape its future outlook. One significant trend is the increasing focus on sustainable and ethical sourcing of silver. Consumers are becoming more conscious of the environmental and social impact of the products they purchase, urging companies to adopt responsible mining practices.

Moreover, the silver market experiences fluctuations in prices, making it an attractive investment option. Historically, silver has served as a hedge against inflation and economic uncertainties. As investors continue to seek refuge in safe-haven assets, the demand for silver as an investment is likely to persist.

Additionally, geopolitical factors, such as trade policies and economic developments, can greatly affect the silver market. Changes in government regulations and global trade relations may influence the overall supply and demand dynamics of silver, consequently impacting its price.

In conclusion, the future projections for silver are promising as technology drives its demand and market trends shape its trajectory. As we witness further advancements in technology and a shift towards sustainable practices, silver is expected to continue its significant role in various industries.

Frequently Asked Questions On Silver Price Fintechzoom

What Factors Influence The Price Of Silver?

Silver prices are influenced by various factors such as supply and demand, economic conditions, and geopolitical events. Industrial usage and investment demand also play a significant role in determining the price of silver.

How Can I Invest In Silver?

You can invest in silver through various ways including purchasing physical silver such as coins and bars, investing in silver ETFs, and trading silver futures. Each method has its own advantages and considerations, so it’s essential to research and choose the best option for your investment goals.

Is Silver A Good Hedge Against Inflation?

Yes, silver is often considered a hedge against inflation as it tends to retain its value over time, especially during periods of rising prices. Historically, silver has served as a store of value, making it an attractive option for investors seeking to protect their wealth during inflationary periods.

Conclusion

To summarize, the silver price is a critical factor for investors and traders in the financial market. Tracking silver price trends and analyzing market indicators can provide valuable insights for making informed decisions. Fintechzoom offers a comprehensive platform for monitoring and analyzing silver prices, ensuring that users stay updated with real-time data and expert analysis.

By utilizing Fintechzoom, investors can enhance their investment strategies and maximize their profit potential in the silver market. Start benefiting from the advanced tools and features today.