IBM’s stock, traded as IBM on the New York Stock Exchange, is followed closely by investors in the technology sector. Its performance is pivotal in understanding the health of the global tech market.

With a history that spans over a century, International Business Machines Corporation (IBM) stands as a testament to innovation and evolution in the computing industry. Often seen as a bellwether for the tech industry, IBM’s stock reflects the company’s ongoing transformation towards cloud computing and artificial intelligence services.

The company’s continuous efforts to reinvent its portfolio, including strategic acquisitions and research investments, make it a significant subject of financial analysis. Investors and market analysts scrutinize IBM’s quarterly earnings reports to gauge the company’s progress and stock potential. This scrutiny stems from IBM’s impact on technology trends and its influence on the complex ecosystem of global business technology solutions.

Fintechzoom’s Take On The Recent Surge In Ibm Stock

IBM’s stock has recently caught everyone’s attention. Thriving in the dynamic tech landscape, it has shown a robust surge. People want answers, and Fintechzoom provides them.

Catalysts Behind The Soaring IBM Profits

Several factors have fueled IBM’s impressive financial uptick. Let’s explore those catalysts:

- Strategic Acquisitions: IBM’s smart buys have diversified its portfolio.

- Cloud Computing Growth: A strong foothold in this sector has driven profits.

- AI Innovations: Advancements in AI have given IBM a competitive edge.

Industry Reactions To The Stock Performance

IBM’s stock surge has not gone unnoticed. Industry experts and companies have quickly responded.

| Expert/Company | Reaction |

|---|---|

| Analysts: | Upbeat forecasts and ratings upgrades. |

| Investors: | Eager buy-ins, expecting long-term benefits. |

| Competitors: | A mix of strategy re-evaluations and partnerships. |

Credit: en.wikipedia.org

IBM’s Transformation Journey

At the heart of technology evolution, IBM’s Transformation Journey stands out. This iconic company has redefined its goals. It targets innovative technologies. These changes ensure IBM remains a tech powerhouse.

Shift To Hybrid Cloud And Ai

IBM has taken bold steps toward the future. The focus now is on Hybrid Cloud and AI. Hybrid Cloud combines public clouds, private clouds, and on-premises resources. It offers flexibility and agility. AI is also front and center. It lets businesses be smarter and more efficient.

- IBM Cloud Paks: These are containerized software solutions. They make cloud services more accessible.

- Red Hat OpenShift: This platform is the backbone. It helps clients build applications once. Then, they can deploy them anywhere.

Strategic Acquisitions And Partnerships

Growth for IBM often means smart partnerships. Acquisitions have been a key part of their strategy. This positions IBM at the forefront of industry innovation.

| Year | Acquisition | Impact |

|---|---|---|

| 2019 | Red Hat | Expanded IBM’s cloud capabilities massively. |

| 2020 | WDG Automation | Strengthened AI-infused automation portfolio. |

Partnerships with companies like Slack and Box also enhance IBM’s collaborative tools.

Financial Highlights From IBM’s Earnings Reports

Financial Highlights from IBM’s Earnings Reports draw a clear picture of the company’s performance. Investors and analysts look at these reports to understand IBM’s economic health. IBM, a trailblazer in the technology sector, regularly publishes these insights, shedding light on its revenue generation and profitability.

Revenue Growth And Profit Margins

A vital sign of a company’s success is its revenue growth and profit margins. IBM’s earnings reports provide this data. They show us how much money IBM made. They also tell us what percentage of this money was profit.

IBM’s revenues can come from different sources. These include software, hardware, and services. Seeing growth in these areas indicates IBM is doing well.

Profit margins are calculated after expenses. They show how efficiently IBM turns revenue into profit. A higher margin means more profit from each dollar of sales.

Comparative Analysis With Prior Quarters

Comparing current results with prior quarters tells us if IBM is improving. Are they making more money now than before? The earnings reports answer this.

This table helps us see trends over time. We look for patterns. We see if profit margins are stable. We can also see how seasonal effects play a role.

- Green rows mean improvement.

- Yellow rows hint at stability.

- Red rows signal a decline.

Credit: theblogote.com

Market Analysts’ Perspectives On Ibm’s Stock

Investing in IBM requires a deep dive into expert opinions. Analysts’ views on IBM stock paint a diverse picture of its potential. They dissect performance, trends, and market movements. Let’s explore what they say.

Bullish Opinions

Optimistic analysts see IBM as a sleeper hit. They believe IBM’s shift to cloud and AI will pay off. Here’s why some are bullish:

- Growth in Hybrid Cloud: IBM’s investment in this area could lead to significant returns.

- Red Hat Acquisition: This move is seen to strengthen IBM’s cloud offerings.

- Stable Dividends: IBM has a history of paying dividends, appealing to income-focused investors.

Bearish Opinions

Some market analysts stay cautious about IBM. They point to possible risks:

- Slow transformation: IBM’s pivot to new technologies might be lagging.

- Competitive market: Despite its efforts, IBM faces strong rivals in the cloud space.

- Financial performance: Recent quarterly reports have left some investors wanting more.

Long-term Investment Potential

Looking beyond temporary fluctuations, long-term potential is a key focus for many. Analysts considering IBM’s future note these points:

| Strengths | Weaknesses |

|---|---|

| Strong brand heritage | High dependence on legacy businesses |

| Global reach | Heavy competition in cloud service |

| Innovative RD | Challenging market dynamics |

Emerging Trends In The Tech Industry

The tech industry never stands still. New advancements and revolutions keep pushing the boundaries of what’s possible. In this spotlight of innovation, we turn our attention to some of the most compelling trends that are setting the stage for future breakthroughs.

Innovations Fueling Growth

Technology’s heartbeat is its constant innovation. Strides in various domains are setting the pace for an exciting future:

- Artificial Intelligence (AI): AI continues to evolve, with machine learning algorithms growing more sophisticated, driving automation and intelligence across sectors.

- Quantum Computing: Organizations are investing in quantum computing to tackle complex problems beyond the reach of classical computers.

- Blockchain Technology: Beyond cryptocurrency, blockchain finds uses in supply chain, healthcare, and fintech, emphasising security and transparency.

- 5G Expansion: The rollout of 5G networks promises lightning-fast connectivity, enabling new services and enhancing existing ones.

Impact On IBM’s Business Model

IBM, a tech leader, stays on the frontline of innovation. These shifts in the industry landscape greatly influence IBM’s strategies:

| Trend | Impact on IBM |

|---|---|

| Artificial Intelligence (AI) | IBM invests in AI, integrating it within their cloud and analytics services. |

| Quantum Computing | The company furthers quantum computing research, developing IBM Q System One. |

| Blockchain | IBM Blockchain creates solutions that improve transparency and efficiency. |

| 5G Technology | Collaboration with network providers to enhance enterprise 5G capabilities. |

Investor Sentiment And Stock Valuation

Investors always want to know what a stock is worth. They look at how others feel about a stock. They also look at numbers that tell them if a stock is a good buy or not. Let’s dive into how these things affect IBM stocks.

Market Volatility And Ibm’s Stock

IBM’s stock price can jump around a lot. This jumping is called market volatility. Sometimes, the whole market shakes, and IBM shakes with it. Other times, news about IBM makes it shake by itself.

Investors watch the Volatility Index (VIX). It shows how much investors think stocks will move. When VIX is high, expect bigger jumps. Let’s see how IBM has been doing:

- IBM has days with big jumps up and down.

- On calm days, it doesn’t move much.

- IBM’s history helps us guess how jumpy it will be.

Valuation Metrics For Tech Stocks

Valuation metrics tell us if a tech stock is cheap or pricey. There are a few important ones to know:

| Metric | What It Means |

|---|---|

| P/E Ratio | Price compared to earnings |

| P/B Ratio | Price compared to the book value |

| PEG Ratio | P/E compared to growth |

Each metric gives clues to IBM’s value. For example, a low P/E means you pay less for each dollar IBM earns. But, alone, these numbers aren’t enough. You should look at them with other stuff, like how IBM compares to other tech stocks or how it’s expected to grow.

Risks And Challenges Facing Ibm

IBM, a pioneer in technology, faces a fast-paced sector. Like all tech giants, IBM must navigate a landscape filled with risk and challenge. Let’s peek into the hurdles they confront, including stiff competition and regulatory frameworks.

Competition In The Cloud And AI Sectors

- In the cloud domain, IBM competes with giants like Amazon AWS and Microsoft Azure. These rivals invest heavily in innovation, squeezing IBM’s market share.

- Artificial Intelligence (AI) is another fierce battleground. Swift advancements by competitors could outpace IBM’s own AI efforts.

- Staying ahead requires constant innovation and strategic partnerships, which IBM pursues to maintain its standing.

Regulatory Hurdles And Data Security

- Data privacy laws, such as GDPR and CCPA, dictate strict compliance. IBM must ensure their services meet these regulations.

- With rising cyber threats, safeguarding client data is crucial. IBM invests in robust security protocols to thwart breaches.

- Failure in compliance or security can lead to significant fines and damage to IBM’s reputation. So, vigilance is key.

Future Outlook For Ibm

International Business Machines Corporation (IBM) stands as a titan in the technology sector. With its distinguished history in innovation, IBM continues to evolve. The company’s adaptation to new technological trends shapes its future. Investors and tech enthusiasts alike keep a keen eye on IBM’s stock performance.

Predictions For Stock Performance

Analysts often assess IBM’s stock performance through diverse economic indicators. Historical trends and market movements give clues to future performance. AI advancements and cloud computing growth may impact IBM stocks positively. Risk factors include tech disruptions and competitive pressures. Bold forecast models suggest varying scenarios. These models weigh in on IBM’s financial health, leadership, and market strategy.

Strategic Initiatives And Growth Prospects

IBM’s strategic initiatives aim for long-term growth. The company invests in high-value segments like artificial intelligence and hybrid cloud. Partnerships with other tech leaders bring innovative solutions to the market. IBM’s digital transformation services attract enterprise clients globally. These efforts suggest opportunities for revenue expansion and improved market share.

- Hybrid cloud: IBM’s commitment to the hybrid cloud positions the company in a fast-growing market.

- AI Integration: Watson AI continues to integrate into various industries, enhancing IBM’s offering.

- Quantum Computing: Investment in quantum computing promises future technological breakthroughs.

- Acquisitions: Strategic acquisitions expand IBM’s capabilities and customer base.

- Research and Development: Continuous investment in R&D fuels innovation and competitiveness.

Frequently Asked Questions On Fintechzoom Ibm Stock

What Is The Current IBM Stock Price?

The current stock price for IBM can vary by the minute. To get the most current price, check financial news websites, stock market apps, or IBM’s official investor relations page for real-time updates.

How Does Fintechzoom Evaluate IBM Stock?

Fintechzoom analyzes IBM stock based on market trends, financial reports, and industry developments. They may provide insights into IBM’s performance, stock ratings, and investment recommendations through detailed articles and analysis pieces.

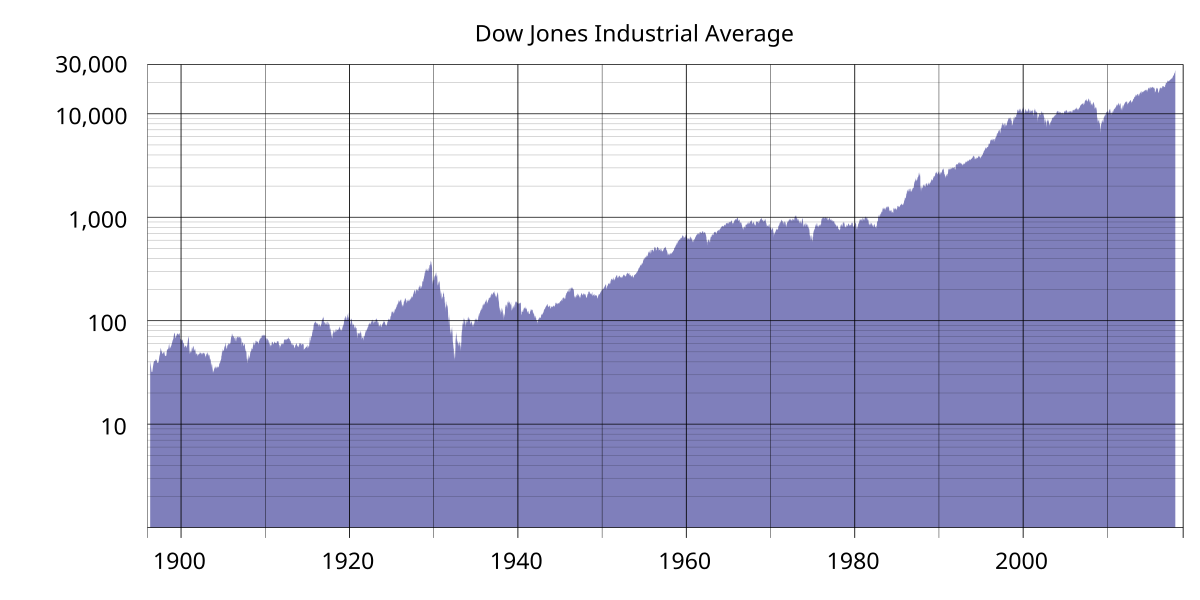

What Is Ibm’s Stock History Performance?

IBM’s stock history has seen many fluctuations. It has experienced historical highs, periods of growth, as well as downturns, reflecting broader economic trends, company-specific news, and tech industry changes. For detailed performance, consider looking at financial charts over various time frames.

Can I Invest In Ibm Stock Through Fintechzoom?

Fintechzoom provides financial insights and information but does not offer investment services. To invest in IBM stock, consult a licensed broker or use an online brokerage platform.

Conclusion

Navigating the dynamic landscape of IBM’s stock within the fintech world requires diligence. Keeping abreast of market trends and emerging technologies will guide informed decisions. Trust Fintechzoom for timely insight on IBM and other investment opportunities—it’s your compass in the ever-evolving financial tech realm.