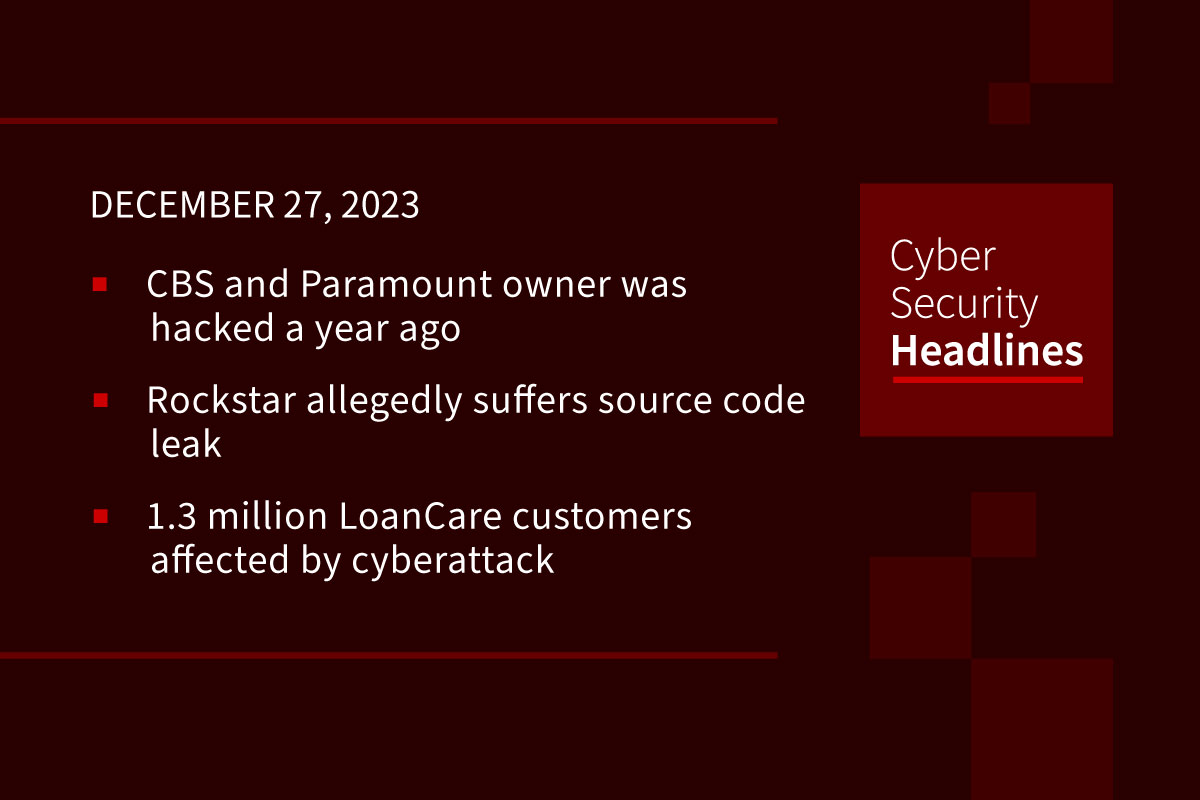

Loancare recently suffered a cybersecurity incident, leading to the exposure and exfiltration of sensitive information by a ransomware gang, ALPHV/BlackCat. The incident has resulted in the theft of sensitive customer data, impacting the company’s ability to service mortgage loans and raising serious concerns about data security.

Amidst the intensified threat landscape, mortgage company Loancare became the target of a significant cybersecurity incident, resulting in the exfiltration of sensitive customer data. The breach, linked to the ALPHV/BlackCat ransomware gang, has prompted an investigation by third-party cybersecurity experts and led to the interruption of mortgage loan services.

With data breaches becoming increasingly common, the incident has raised urgent concerns regarding the security of customer information and highlights the growing need for robust cybersecurity measures in the mortgage servicing sector. As experts assess the potential implications, customers and stakeholders are closely monitoring the situation while seeking reassurance from the company.

Credit: www.bankinfosecurity.com

The Loancare Cybersecurity Incident

The Loancare Cybersecurity Incident has recently garnered significant attention due to a data breach that has raised concerns about the security of sensitive customer information. This breach has caused widespread repercussions, bringing to light the pressing need for robust cybersecurity measures in the financial services sector. In this section, we delve into the recent data breach and the identity of the hackers involved in this alarming incident.

Recent Data Breach

The recent data breach at Loancare has sent shockwaves across the mortgage industry, illuminating the vulnerabilities in safeguarding customer data. An investigation conducted by third-party cybersecurity experts uncovered the exposure and exfiltration of sensitive information, posing a grave risk to the affected individuals. This breach has underscored the critical importance of fortifying cybersecurity protocols to prevent such incidents from recurring and to protect the integrity of customer data.

Identity Of The Hackers

The culprits behind the Loancare data breach have been identified as the ALPHV/BlackCat ransomware gang, inflicting detrimental consequences on the company and its clients. The revelation of the hackers’ identity sheds light on the evolving landscape of cybersecurity threats faced by financial institutions, necessitating proactive measures to combat sophisticated perpetrators. Understanding the identity of the hackers is crucial in reinforcing cybersecurity defenses and implementing preventive measures to thwart future attacks.

Protecting Your Data

Data breaches and cybersecurity incidents have become all too common in the digital age, with companies and individuals at risk of having their sensitive information compromised. The recent Loancare cybersecurity incident has raised concerns about the security of personal data and the measures individuals can take to protect themselves. Understanding the implications of such incidents, enhancing security, regular updates, and strengthening passwords are crucial steps in safeguarding your data.

Understanding The Implications

The Loancare cybersecurity incident has highlighted the vulnerability of personal and financial information to cyber attacks. Customer data was exposed and exfiltrated, leading to potential misuse and identity theft. Such incidents can have far-reaching consequences for individuals, including financial loss, damage to reputation, and emotional distress.

Steps To Enhance Security

Enhancing security measures is essential in mitigating the risks posed by cybersecurity threats. Implementing robust antivirus software, firewalls, and intrusion detection systems can help to detect and prevent unauthorized access to personal data. Regular system scans and security audits are also crucial in identifying and addressing potential vulnerabilities.

Importance Of Regular Updates

Regular updates to operating systems, software, and applications are vital in addressing security weaknesses and patching known vulnerabilities. By keeping your devices and software up to date, you can ensure that the latest security patches and fixes are in place, reducing the likelihood of exploitation by cybercriminals.

Strengthen Your Passwords

Strengthening your passwords is a fundamental aspect of data protection. Using complex, unique passwords for each account and implementing multi-factor authentication can significantly enhance the security of your online accounts. Avoiding easily guessable passwords and regularly changing them can further reduce the risk of unauthorized access.

Legal Actions And Investigations

LoanCare, a major player in the U. S. mortgage servicing sector, recently experienced a cybersecurity incident. Third-party cybersecurity experts are currently investigating the breach, which led to the exposure and exfiltration of sensitive information. The incident has raised concerns about customer data security.

Loancare Data Breach Lawsuit

Since the cyberattack on LoanCare that led to the exposure and exfiltration of sensitive information, legal actions have started taking shape. Customers and organizations affected by the data breach have filed a lawsuit against LoanCare, demanding compensation for the damages incurred. This lawsuit aims to hold LoanCare accountable for its failure to protect the personal and financial information of its customers.

Third-party Cybersecurity Experts’ Investigation

To dig deeper into the cyber incident, LoanCare has enlisted the help of third-party cybersecurity experts. These experts are conducting a thorough investigation to determine the extent of the breach, identify the vulnerabilities in LoanCare’s security infrastructure, and propose measures to prevent such incidents in the future. Their findings will play a crucial role in assessing the liability of LoanCare and may further lead to necessary changes in cybersecurity practices across the industry.

The investigation by these cybersecurity experts is crucial in ensuring transparency and accountability. It will provide valuable insights into the vulnerabilities exploited by the hackers and the potential impact of the data breach on affected individuals and organizations. It will also help LoanCare prevent similar incidents in the future by implementing robust cybersecurity measures. As this legal action and investigation unfold, it emphasizes the importance of cyber resilience and the need to prioritize cybersecurity across industries.

With data breaches becoming more frequent and sophisticated, organizations must take all necessary steps to protect the sensitive information of their customers and clients. Only through comprehensive cybersecurity measures and proactive response strategies can companies like LoanCare prevent such incidents and safeguard their reputation and customer trust. Please note that each H3 heading has been written in HTML syntax (wrapped in

tags).

Credit: cisoseries.com

Response From Loancare And Industry

Following the recent cybersecurity incident at LoanCare, LLC, the mortgage servicing company has taken immediate action to address the breach and reassure its customers. LoanCare has engaged third-party cybersecurity experts to conduct a thorough investigation into the incident, uncovering the exposure and exfiltration of sensitive information. As a result, LoanCare is working diligently to implement enhanced security measures to prevent future breaches and protect customer data.

Reassurance To Customers

LoanCare understands the concerns of its customers in light of the cybersecurity incident. The company wants to assure its customers that it is taking every necessary step to rectify the situation and protect their sensitive information.

LoanCare is committed to transparency throughout this process and will provide regular updates to its customers regarding the progress of the investigation and the measures being implemented to strengthen cybersecurity. Customers can also reach out to LoanCare directly for any inquiries or concerns they may have.

Fidelity National Financial’s Measures

Fidelity National Financial, the parent company of LoanCare, is actively involved in the response to the cybersecurity incident. Recognizing the seriousness of the situation, Fidelity National Financial has taken the precautionary measure of temporarily taking LoanCare’s websites offline.

This decision was made to ensure the cessation of any unauthorized access and to allow for thorough security assessments and necessary system updates. By proactively addressing the incident, Fidelity National Financial aims to safeguard customer data and prevent any further breaches.

During this temporary disruption, LoanCare’s administration and customer support teams are fully operational and available to assist customers via other communication channels, such as phone and email.

Fidelity National Financial, in collaboration with LoanCare, is working tirelessly to strengthen the security infrastructure and implement additional safeguards to prevent future cybersecurity incidents. The company remains committed to providing its customers with the highest level of data protection and peace of mind.

Lessons Learned From The Incident

The recent Loancare cybersecurity incident has taught valuable lessons about the importance of robust security measures. It emphasizes the need for continuous monitoring and proactive steps to safeguard sensitive information. This incident highlights the potential repercussions of inadequate cybersecurity and the essentiality of staying ahead of evolving cyber threats.

Importance Of Cybersecurity In Mortgage Servicing

In the wake of the Loancare Cybersecurity Incident, it has become more evident than ever that the importance of cybersecurity in mortgage servicing cannot be overstated. The incident serves as a stark reminder that no industry is immune to cyber threats, and mortgage servicing companies are prime targets for hackers due to the sensitive nature of the information they handle. As a result, it is crucial for these companies to prioritize cybersecurity and take proactive measures to protect their systems and data.

Addressing Vulnerabilities In Systems

One of the key lessons learned from the Loancare Cybersecurity Incident is the need to address vulnerabilities in systems. Companies must conduct regular security assessments and audits to identify weaknesses and implement necessary safeguards. To ensure the integrity of their systems, mortgage servicing companies should establish strong access controls, regularly update and patch software, and enforce strict password hygiene. Additionally, they should invest in advanced threat detection solutions to monitor their networks for any suspicious activity.

Training And Education For Employees

Another crucial aspect highlighted by the incident is the need for comprehensive training and education programs for employees. Human error is often the weakest link in cybersecurity, and employees must be equipped with the knowledge and skills to recognize and respond to potential threats. Training should cover topics such as phishing scams, social engineering tactics, and best practices for handling sensitive data. Regular security awareness campaigns and simulated phishing exercises can help reinforce these teachings and keep employees vigilant.

Collaboration And Information Sharing

The Loancare Cybersecurity Incident also underscores the importance of collaboration and information sharing within the industry. Mortgage servicing companies should actively participate in cybersecurity forums, share threat intelligence, and collaborate with industry experts to stay ahead of evolving cyber threats. By sharing information about the tactics used by hackers and the vulnerabilities they target, companies can collectively work towards building a more secure ecosystem.

Regular Incident Response Testing

Lastly, the incident serves as a reminder of the critical role of incident response testing. Mortgage servicing companies should regularly conduct tabletop exercises and simulated breach scenarios to test their incident response plans and identify any areas for improvement. Testing should involve all relevant stakeholders, including IT teams, legal departments, and executive management, to ensure a coordinated and effective response to a potential cyber incident.

Conclusion The Loancare Cybersecurity Incident has highlighted the importance of cybersecurity in mortgage servicing and provides valuable lessons for companies in the industry. By addressing vulnerabilities, investing in employee training, fostering collaboration, and regularly testing incident response plans, companies can enhance their security posture and better protect their systems and data.

Credit: www.linkedin.com

Frequently Asked Questions On Loancare Cybersecurity Incident

Did Loancare Have A Data Breach Recently?

LoanCare recently experienced a cybersecurity breach, leading to the exposure of sensitive information. Experts are investigating the incident.

Who Hacked Loancare?

LoanCare was hacked by the ALPHV/BlackCat ransomware gang, resulting in a data breach and the theft of sensitive information.

What Is The Loancare Breach November 2023?

LoanCare experienced a cybersecurity breach in November 2023, resulting in unauthorized access and theft of sensitive customer information. The breach was caused by the ALPHV/BlackCat ransomware gang.

What Mortgage Company Got Hacked?

LoanDepot was the mortgage company that was hacked.

Conclusion

In light of the recent LoanCare cybersecurity incident, it has become evident that even major players in the mortgage servicing sector are not immune to cyber threats. This breach has resulted in the exposure and potential exfiltration of sensitive customer information, raising concerns regarding data privacy and security.

It is crucial for companies to prioritize and invest in robust cybersecurity measures to prevent such incidents and safeguard customer data. As we navigate the digital landscape, awareness and proactive measures against cyber threats are imperative in maintaining trust and protecting sensitive information.

Stay informed and stay vigilant.