Stay informed with FintechZoom’s expert analysis of Brent Crude oil prices. Understand market trends and make informed decisions.

You’ve clicked on this article because you want the inside scoop on Brent Crude prices. As an investor or trader, you know that following oil prices is crucial to making the right moves in the market. But with prices constantly fluctuating, it’s hard to keep up.

That’s where FintechZoom comes in. For over a decade, we’ve been providing traders and investors with cutting-edge analysis of Brent Crude prices. Our team of experts tracks every twist and turn in the oil markets so you don’t have to.

In this article, we’ll break down all the factors impacting prices right now. You’ll get our latest forecast on where Brent Crude is headed and key price levels to watch. Whether you’re looking to time your trades or find new opportunities, you’ll find the intelligence you need right here. So buckle up for an in-depth look at the forces shaping Brent Crude prices!

Understanding Brent Crude Oil Prices

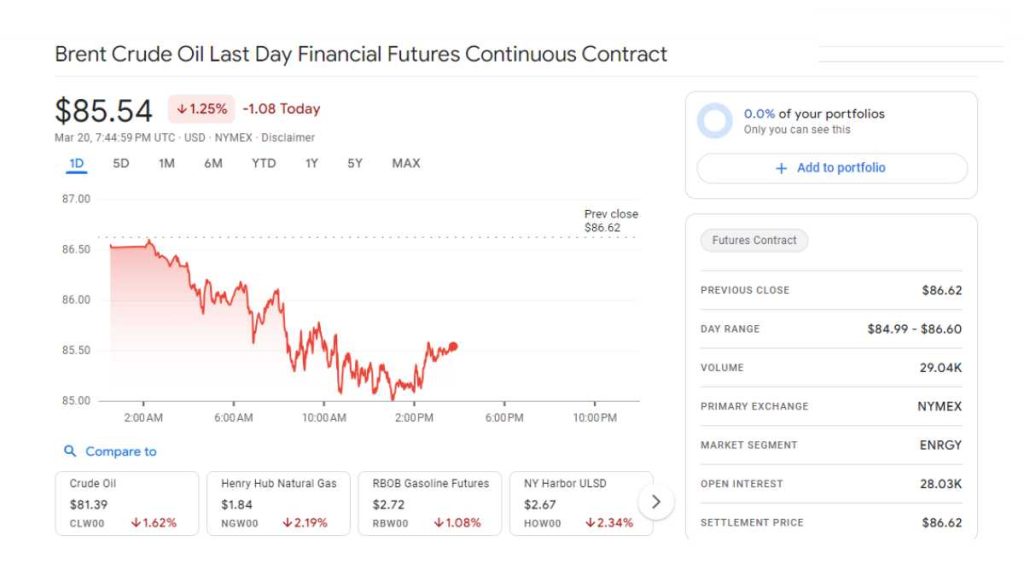

Brent Crude Oil Prices:

| Date | Price (USD/BBL) | Change | % Change |

|---|---|---|---|

| 2024-03-19 | 87.37 | +0.48 | +0.55% |

| 2024-03-18 | 86.89 | -0.50 | -0.58% |

| 2024-03-17 | 147.50 | – | – |

| 2024-03-16 | 2.23 | – | – |

What is Brent Crude?

Brent Crude is a major trading classification of sweet light crude oil that serves as a benchmark price for oil worldwide. It’s extracted from the North Sea and contains low sulfur, making it easier to refine into petroleum products like gasoline. Brent Crude is measured in barrels, with each barrel holding 42 U.S. gallons.

What Influences the Price?

Several factors determine the price of Brent Crude oil. Supply and demand is a big one. When supply is low or demand is high, prices go up. The opposite is also true. Geopolitical events like conflicts, wars, or tensions in oil-producing nations can also cause prices to spike.

Watch the Economy

The overall health of the global economy significantly impacts oil prices. When economies are growing, demand for oil and gas increases which pushes prices up. Recessions or slow growth periods usually mean lower demand and lower prices. Keep an eye on key economic indicators like GDP growth, manufacturing activity, and consumer spending to anticipate potential price changes.

OPEC Controls Supply

The Organization of the Petroleum Exporting Countries (OPEC) regulates supply and largely controls the price of oil. OPEC members produce about 44 percent of the world’s crude oil. When OPEC limits production, it usually means higher prices. Increased production typically leads to lower prices. OPEC meets regularly to determine future production levels, so investors closely watch their policy decisions.

Hedge Your Bets

Businesses that depend heavily on oil often hedge against price volatility using futures contracts. This allows them to lock in oil prices for future delivery and better manage costs. While hedging is complex, it helps companies budget more accurately and avoid price shocks that could impact profitability. For investors, hedging also provides opportunities to profit whether oil prices rise or fall.

What Drives Brent Crude Oil Price Fluctuations

The price of Brent crude oil, the leading global price benchmark for Atlantic basin crude oils, depends on global supply and demand. Several factors influence how much oil is produced and consumed around the world.

| Factors | Description |

|---|---|

| Supply and Demand | Fluctuations in global supply and demand impact oil prices. Geopolitical events, production levels, and consumption trends play a crucial role. |

| Geopolitics | Political events, conflicts, and sanctions affect oil markets. Tensions in oil-producing regions can lead to price volatility. |

| Economic Growth | Strong economic growth increases oil demand, while slowdowns reduce it. Economic indicators influence market sentiment. |

| Market Speculation | Traders and investors speculate on future oil prices, affecting short-term fluctuations. |

| OPEC Decisions | The Organization of the Petroleum Exporting Countries (OPEC) sets production targets, impacting global supply. |

| Weather and Natural Disasters | Hurricanes, extreme weather, and disruptions to production facilities affect supply. |

| Financial Markets | Commodity index investments, futures positions, and correlations with other assets impact oil prices. |

Global economic growth

When economies are expanding, demand for oil increases as people travel more and buy additional goods and services. During economic downturns, demand declines. Recently, the COVID-19 pandemic significantly reduced global economic activity and demand for oil. As vaccines roll out and economies reopen, oil demand is rebounding and putting upward pressure on prices.

Production levels of OPEC and non-OPEC countries

The Organization of the Petroleum Exporting Countries (OPEC) and non-OPEC oil-producing allies, like Russia, meet regularly to discuss coordinated production levels. When they curb output, it often leads to higher oil prices as supply tightens relative to demand. When they boost production, it usually means lower prices as more supply comes online. OPEC+ recently agreed to gradually increase output to meet rising demand.

Geopolitical events

Tensions in oil-producing regions can threaten supply and drive prices higher due to fears of potential supply disruptions. Conflicts, sanctions, or political turmoil in places like the Middle East, Africa, or South America are closely monitored by oil traders. Price spikes tend to be temporary but highlight the fragility of global oil supplies.

Technological improvements

Advances in drilling and exploration technologies have enabled more oil production over time. Fracking and horizontal drilling have unlocked oil and natural gas from shale formations in the U.S., boosting domestic output.

However, if new technologies stall or environmental concerns curb production gains, it could put upward pressure on oil prices. Overall, multiple interconnected factors drive the ups and downs of Brent crude oil prices daily. Staying on top of key global events and trends will help you understand what’s moving the market.

FintechZoom’s Brent Crude Price Forecast

FintechZoom analysts expect Brent crude oil prices to remain volatile but range-bound in the coming months. Demand for oil is slowly recovering as major economies emerge from pandemic lockdowns, but a resurgence of COVID-19 cases could hamper the rebound.

On the supply side, OPEC and its allies agreed to boost production to meet rising demand. However, some members like Nigeria and Angola have struggled to pump more oil due to underinvestment in infrastructure and maintenance.

| Year | Average Price (USD/BBL) |

|---|---|

| 2022 | $90 |

| 2023 | $83 |

| 2024 | $88.7 |

Upside risks

Geopolitical tensions could drive prices higher if they disrupt supply. Sabotage attacks on oil infrastructure or a broader conflict in the Middle East are upside risks to watch. A quicker-than-expected economic rebound, especially in major oil importers like China and India, may also support higher prices.

Downside risks

A resurgence of COVID-19 infections leading to more lockdowns and a slower demand recovery is a key downside risk. OPEC and its allies could also choose to unleash more production if prices move sustainably above $70 a barrel. This may cap further upside in the coming months.

Overall, FintechZoom expects Brent crude oil prices to trade in a range of $65 to $75 a barrel for the rest of 2021. A lot will depend on how fast demand recovers and whether OPEC remains disciplined in managing supply. Of course, unexpected events can always throw the market for a loop, so monitor geopolitical and macroeconomic news closely in case of surprises. By understanding the forces influencing oil prices, you can make better decisions to hedge risk or find opportunities.

How to Trade Brent Crude Oil Futures

To trade Brent crude oil futures, you’ll first need to open an account with a broker that allows futures trading. Once your account is funded, you’re ready to make your first trade.

| Step | Description |

|---|---|

| 1 | Learn What Moves Crude Oil: Understand the supply and demand dynamics, global economic factors, and technical indicators that impact crude oil prices. |

| 2 | Understand the Crowd: Recognize that professional traders and hedgers dominate energy futures markets, while retail traders have less influence. |

| 3 | Choose Between Brent and WTI Crude Oil: Decide whether to trade West Texas Intermediate (WTI) or Brent Crude oil futures. Both have unique characteristics and are traded on different exchanges. |

Choose an expiration date

Brent crude futures contracts expire monthly, so you’ll need to choose whether you want to trade the front-month contract (the closest to expiration) or a contract further out. The front-month contract is more volatile, while longer-dated contracts are more stable. For most traders, the 3- to 6-month contracts offer a good balance of volatility and liquidity.

Decide whether to go long or short

Going long means buying a contract in anticipation of prices rising. Going short means selling a contract in anticipation of falling prices. Do your research to determine whether you think oil prices are heading up or down.

Place a buy or sell order

Put in an order to buy (go long) or sell (go short) a Brent crude oil futures contract. You’ll need to specify the contract month, price, and number of contracts you want to trade. Most traders start with just 1 contract, which equals 1,000 barrels of oil.

Monitor and exit your position

Once your order is filled, you’ll need to actively monitor the Brent crude price and be ready to exit your position. If going long, place a sell order to exit once prices start falling. If going short, buy a contract to exit as prices start to rise. You can also set stop-loss and profit target orders to automatically exit at a maximum loss or desired gain.

Trading Brent crude oil futures allow you to speculate on the changing price of oil. But keep in mind that futures trading is very risky, and you can lose money quickly if the market moves against your position. Always do your research, use tight stop-losses, and never risk more money than you can afford to lose. With practice and discipline, trading Brent crude oil futures can be a lucrative endeavor.

Frequently Asked Questions About FintechZoom Brent Crude Price

What exactly is Brent crude oil?

Brent crude oil is a light, sweet crude oil sourced from the North Sea. It’s used as a benchmark for oil prices globally. Brent crude is a high-quality oil that is easy to refine into gasoline, diesel, and other petroleum products.

How are Brent crude oil prices determined?

Brent crude oil prices are determined by the supply and demand in the global oil market, as well as geopolitical events. Things like production levels in oil-exporting countries, global economic growth, political instability, natural disasters, and speculation can all impact the price of Brent crude.

How can I invest in Brent crude oil?

There are a few ways to invest in Brent crude oil:

- Buy shares of oil companies that produce Brent crude like Royal Dutch Shell or BP. As Brent crude prices rise, these companies’ profits and stock prices also tend to increase.

- Trade Brent crude oil futures contracts. Futures allow you to speculate on the future price of Brent crude. If prices go up, you can sell the contracts at a profit.

- Invest in oil ETFs or ETNs that track Brent crude prices. Popular options include the United States Brent Oil Fund (BNO) and the iPath Series B S&P GSCI Crude Oil Total Return Index ETN (OIL).

How can I track the price of Brent crude oil?

The price of Brent crude oil is reported in dollars per barrel. You can track Brent crude prices on major financial websites like:

- FintechZoom – We provide real-time data and analysis on Brent crude oil prices and the factors driving the market.

- CNBC – They offer live Brent crude price quotes, charts, news, and analysis.

- Bloomberg – Bloomberg has a section dedicated to energy news and market data including live Brent crude oil pricing.

- Yahoo Finance – They provide free quotes, charts, headlines, and analysis for Brent crude oil. You can also add Brent crude to your watchlist to get notifications on price changes.

Monitoring Brent crude oil prices regularly will help you understand trends in the oil market and make well-informed investment decisions. Let us know if you have any other questions!

Conclusion

You know, staying on top of the latest market trends with a resource like FintechZoom can really give you an edge when it comes to making smart choices around energy investments. Their Brent Crude analysis breaks it down in an insightful way without getting too technical or jargon.

Whether you’re just looking to be an informed consumer or you have some skin in the oil trading game, getting the latest intel from experts is hugely valuable. So be sure to keep tuning into FintechZoom to get the knowledge you need to make the right moves. With all the fluctuations these days in energy markets, having a reliable source for straightforward analysis of prices is a must.