Several U.S. Banks, including Ally Bank and USA, accept cryptocurrency-related transactions. They provide services for the purchase and liquidation of digital assets.

Cryptocurrency has revolutionized the financial landscape, prompting some U. S. Banks to adapt their services to meet the growing demand for crypto transactions. As digital currencies gain mainstream acceptance, banking institutions like Ally Bank have emerged as crypto-friendly, offering an avenue for customers to link their bank accounts with cryptocurrency exchanges.

USAA, recognizing the potential of blockchain technology, also permits members to integrate their accounts with prominent crypto wallets, simplifying the monitoring of their digital investments. These pioneering banks are setting a precedent, gradually bridging the gap between traditional banking and the burgeoning world of cryptocurrencies, and catering to a tech-savvy clientele that values innovation and digital asset management.

Credit: www.therinklive.com

Introduction

Explore the dynamic landscape of U. S. financial institutions that now embrace cryptocurrency, offering customers innovative ways to manage digital assets. Discover which banks are pioneering this integration, positioning themselves at the forefront of the fintech revolution.

The Intersection Of Traditional Banking And Digital Currency

The financial landscape is evolving rapidly, with digital currencies carving out a sizable niche in the market. Among these developments, several U. S. Banks are emerging as crypto-friendly institutions, willing to bridge the gap between traditional banking services and the burgeoning world of cryptocurrencies.

These banks recognize the importance of adapting to the digital age by offering services that cater to the needs of crypto enthusiasts and investors.

Advantages Of Crypto-friendly Banks

Cryptocurrencies offer unique benefits that have spurred their adoption worldwide. Here is why some U. S. Banks are incorporating them into their services:

- Diversification: Cryptocurrencies represent a new asset class that can help diversify a portfolio.

- Innovation: By embracing crypto, banks position themselves at the forefront of financial technology innovation.

- Customer Demand: A growing segment of customers seeks banking solutions that accommodate digital currencies.

- Security: With robust security measures, banks can provide a safe environment for crypto transactions.

Selecting A Crypto-accepting Bank

Choosing a bank that accepts cryptocurrencies involves a careful assessment of several factors:

- Service Offerings: Evaluate the variety of crypto-related services provided, such as crypto savings accounts or Bitcoin-friendly debit cards.

- Regulatory Compliance: Ensure the bank is compliant with all regulations, guaranteeing the legality and security of your crypto transactions.

- Technology Integration: Check how seamlessly the bank integrates cryptocurrency with traditional banking services, optimizing user experience.

Customer Experience And Crypto Banking

A crucial aspect of crypto-friendly banks is the customer experience they deliver. It encompasses:

- User Interface: A streamlined and intuitive online platform enhances the ease of managing crypto transactions.

- Support Services: Reliable customer support, and knowledge about cryptocurrencies, are vital for addressing any issues that may arise.

- Community Engagement: Banks that engage with the crypto community often provide better-tailored services and stay updated on the latest trends and demands.

The Future Outlook Of Crypto Banking

The trajectory of cryptocurrency acceptance in U. S. Banks indicates a promising future. Innovations and advancements in blockchain technology will continue to push banks toward more comprehensive crypto integration. This forward-thinking approach can potentially lead to a financial ecosystem where digital currencies are as commonplace and accessible as traditional fiat currencies.

Types Of Crypto-friendly Banks

Discover U. S. banks that welcome cryptocurrency, bridging traditional finance with digital assets. These institutions offer seamless integration for crypto transactions, catering to the needs of blockchain enthusiasts and investors.

Exploring the dynamic world of cryptocurrencies, it’s evident that more U. S. Banks are adapting to the changing financial landscape. Whether you’re a seasoned crypto investor or a curious newcomer, understanding which banks welcome your business can open a realm of possibilities.

Let’s delve into the types of crypto-friendly banks that are making waves in this digital era.

Traditional Banks Embracing Cryptocurrency

Gone are the days when traditional banks viewed cryptocurrency with skepticism. A growing number of these institutions now recognize the transformative potential of digital assets. Here’s how they’re adapting:

- Custodial Services: These banks offer secure storage for your cryptocurrencies, protecting them from the vulnerabilities often associated with personal wallets.

- Investment Opportunities: By providing access to various crypto investment products, these banks cater to both novice traders and experienced investors.

Internet-only Banks With Crypto Services

The rise of internet-only banks has brought major changes, as they cater to the tech-savvy and those favoring modern financial solutions. Here’s what sets them apart:

- Lower Fees: With no overhead for physical branches, these banks can offer reduced fees for transactions involving cryptocurrencies.

- Innovative Tools: From real-time crypto transactions to integrated investment platforms, they harness the power of technology to provide seamless services.

Credit Unions Offering Alternative Options

It might come as a surprise, but some credit unions are at the forefront of cryptocurrency adoption. They blend the personal touch of member-focused banking with an appetite for innovation.

- Educational Resources: For members exploring the crypto space, credit unions frequently offer guidance and educational materials.

- Community Trust: As established community institutions, they often serve as a bridge for those cautious about the leap into digital currencies.

Neobanks Trailblazing In Crypto Integration

Neobanks, the fintech revolutionaries, are spearheading the integration of cryptocurrency into everyday banking. They’re designed for a digital-centric clientele who demand immediacy and innovation:

- Real-Time Crypto Exchanges: Many neobanks offer instant exchange services between fiat and cryptocurrencies, streamlining the transaction process.

- User-Friendly Interfaces: They pride themselves on intuitive platforms that simplify the crypto experience for all users.

Discussing U. S. Banks and their stance on cryptocurrency reveals a landscape ripe with opportunities. From established players dipping their toes in digital waters to innovative neobanks rewriting the rules, the banking sector is more crypto-friendly than ever. With careful consideration and a strategic approach, navigating this space can lead to exciting financial prospects in the burgeoning world of cryptocurrency.

Examples Of U.S. Banks That Accept Cryptocurrency

Exploring U. S. banks that embrace cryptocurrency reveals a growing list, including prominent names like JPMorgan Chase and Ally Bank. These institutions recognize digital currencies, offering clients innovative financial solutions.

The realm of finance is brimming with technological advancements, and U. S. Banks are no exception. As cryptocurrencies have gained traction, an increasing number of financial institutions have started to recognize their potential. By integrating digital currencies into their services, these banks cater to a niche market of tech-savvy investors while also embracing the future of money.

Bank Of New York Mellon (BNY Mellon)

One of the oldest banks in the United States, BNY Mellon, made a splash when it announced its acceptance of cryptocurrencies. This decision reflects a strategic move to modernize its asset management:

- Services Expansion: BNY Mellon plans to offer digital currency services similar to those provided for traditional assets.

- Innovation Adoption: By integrating crypto custody and management, the bank embraces innovation, securing its standing in the fast-evolving financial sector.

J.p. Morgan Chase & Co.

As a leading global financial services firm, J. P. Morgan Chase has shown an open-minded approach towards cryptocurrencies, realizing the importance of staying ahead in the digital finance race:

- J.P. Morgan Coin: They pioneered the J.P. Morgan Coin, a digital token that represents a fiat currency, which could revolutionize payments between institutional clients.

- Blockchain Research: The bank is deeply invested in blockchain technology, ensuring secure and efficient transactions, which translates to a strong endorsement of crypto principles.

Goldman Sachs

Goldman Sachs, known for its investment banking prowess, has relaunched its cryptocurrency trading desk, a bold step that highlights its commitment to crypto markets.

- Trading Desk Revival: After a brief hiatus, the trading desk’s reestablishment signifies Goldman Sachs’ confidence in cryptocurrency’s liquidity and long-term viability.

- Crypto Investment Options: Providing various crypto investment instruments, the bank caters to clients interested in this asset class, strengthening its diverse portfolio.

Silvergate Bank

Silvergate Bank has carved out a name for itself in the world of digital currency, becoming a go-to bank for crypto-related transactions with services tailored for crypto traders and exchanges:

- Exchange Network: Its proprietary Silvergate Exchange Network (SEN) facilitates real-time, around-the-clock transfers for institutional investors, reinforcing its niche banking expertise.

- Crypto Focus: Focusing on crypto services from the outset, Silvergate Bank leverages its robust infrastructure to offer innovative banking solutions to the fintech industry.

The integration of cryptocurrency in traditional banking systems is a revolutionary step forward, merging the reliability of established financial institutions with the dynamic nature of digital currencies. These examples portray the evolving landscape of U. S. Banks that are not just acknowledging cryptocurrencies but are strategically positioning themselves to be at the forefront of this digital revolution.

Their adaptation and the provided services are a testament to the growing influence of cryptocurrencies in shaping the future of finance.

Features And Services Offered By Crypto-friendly Banks

U. S. banks embracing cryptocurrencies provide innovative services like secure digital asset storage and seamless fiat-to-crypto transactions. These financial institutions support blockchain endeavors, offering advisory for crypto investments and compliance-focused solutions for enthusiasts and businesses alike.

Navigating through the complex world of banking and digital currencies can often be challenging. Thankfully, an increasing number of U. S. Banks are embracing the cryptocurrency wave, offering services specifically tailored to the needs of crypto enthusiasts and investors. Let’s delve into some of the remarkable features and services these pioneering financial institutions provide.

Comprehensive Cryptocurrency Support

The arrival of crypto-friendly banks has been a game-changer for digital currency users who previously struggled with the banking industry’s hesitance. These banks have crafted an ecosystem where traditional banking smoothly integrates with the digital world. The services are not only about the safe keeping of your assets but also include:

- Crypto Trading Accounts: Users can conduct cryptocurrency buy, sell, and exchange transactions directly within their banking platform, streamlining the process.

- Personalized Crypto Services: Tailored solutions for managing digital assets, reflecting each user’s unique investing profile and goals.

Cutting-edge Security For Digital Assets

One of the paramount concerns for any investor or crypto holder is the security of their assets. Crypto-friendly banks in the U. S. Address this anxiety with state-of-the-art security features that ensure peace of mind. These banks utilize the latest in cybersecurity measures and innovative technology to safeguard your investments, including:

- Multi-Factor Authentication (MFA): A mandatory security step that provides an extra layer of defense against unauthorized access to your accounts.

- Cold Storage Solutions: The majority of crypto assets are stored offline, significantly reducing the risk of hacking and online theft.

Integration With Crypto Wallets And Exchanges

A seamless integration with existing cryptocurrency wallets and exchanges allows for a frictionless experience in managing digital assets. Crypto-friendly U. S. Banks have developed services that are in sync with the popular platforms in the crypto space, eliminating the disconnect between traditional banking and digital currencies by offering:

- Direct Transfers to and from Crypto Wallets: This feature simplifies the process of moving assets between the bank and your preferred crypto wallet.

- Expedited Verification with Exchanges: Banks collaborate with exchanges to fast-track the necessary KYC processes, vastly improving the experience.

Innovative Financial Products For Crypto Users

As the crypto market matures, the demand for innovative financial products tailored to crypto users grows. Recognizing this, crypto-forward banks are pioneering services that accommodate the diverse needs of their customers. They offer a variety of avant-garde financial instruments and products that include:

- Crypto-Backed Loans: These allow individuals to obtain fiat currency loans using their cryptocurrency as collateral without the need to liquidate their holdings.

- Yield-Generating Accounts for Crypto: Users can earn interest on their cryptocurrency deposits, akin to a traditional savings account but potentially at higher rates.

Educational Resources And Customer Support

Understanding cryptocurrency can be an overwhelming task for newcomers. Crypto-friendly banks bridge this knowledge gap with dedicated educational resources and robust customer support designed to help users navigate the digital currency landscape. Such banks enhance customer empowerment through:

- Comprehensive Learning Tools: Whether you’re a seasoned crypto trader or a novice, these banks offer a suite of educational materials to help you understand the intricacies of cryptocurrency.

- Responsive Customer Service: Crypto bankers provide specialized support teams trained to handle inquiries related to digital assets, offering help both for technical issues and investment advice.

U. S. Banks that have adopted cryptocurrency are offering an impressive suite of features and services. They are not only simplifying the integration of digital currencies into everyday banking but also ensuring the security and advancement of crypto-assets in the financial world.

By acknowledging and meeting the specific needs of the crypto community, these banks are at the forefront of the financial sector’s transformation.

Considerations When Choosing A Crypto-friendly Bank

Selecting a US bank for cryptocurrency engagements involves weighing factors like security measures and transaction flexibility. Explore entities offering seamless integration with crypto wallets and exchanges for a streamlined digital currency experience.

Cryptocurrency integration with the U. S. Banking system marks a significant shift, weaving digital assets into conventional finance. A critical step for crypto enthusiasts and investors is selecting a bank that aligns with their digital currency needs and expectations. Here’s what to keep in mind when choosing a bank that’s friendly toward cryptocurrencies.

Security Measures Of The Bank

Opting for a bank that provides robust security measures is paramount. Given cryptocurrency’s digital nature, potential vulnerabilities must be addressed with:

- Advanced encryption technologies: Ensures that your data and digital assets are protected from unauthorized access and cyber threats.

- Two-factor authentication (2FA): Adds an additional layer of security beyond just a password, safeguarding your account from breaches.

- Real-time fraud monitoring: Quickly detects any suspicious activity on your account, providing an immediate response to potential threats.

Compatibility With Your Cryptocurrency Goals

When delving into crypto banking, confirm the alignment of the bank’s services with your long-term cryptocurrency objectives:

- Investment support: Whether you’re holding for the long term or engaging in frequent trading, the bank should facilitate your investment strategy with apposite tools and services.

- Crypto-to-fiat transactions: For those who frequently convert between cryptocurrencies and fiat currency, the bank should offer a seamless and cost-effective process.

Customer Support Quality

Personalized customer service is non-negotiable, considering the complexities often associated with cryptocurrency transactions. The bank of your choice should offer:

- Expertise in cryptocurrency: Trained staff knowledgeable about digital currencies can provide the guidance necessary for navigating crypto banking.

- Multiple support channels: This includes accessible phone support, live chat, and email assistance, allowing you to reach out for help through the most convenient means.

Fee Structure Transparency

Understanding the fee structure is essential to avoid unexpected charges that could eat into your crypto earnings:

- Clear fee disclosure: Before committing to a bank, ascertain that all potential fees are transparent and understandable to prevent any hidden charges from cropping up.

- Competitive pricing: Compare the fees with other crypto-friendly banks to ensure you’re getting a fair deal relative to the services provided.

Bank’s Reputation And Stability

Trust in a financial institution is a cornerstone for any banking relationship, so consider:

- Regulatory compliance: A reputable bank adhering to regulatory standards is likely to ensure the security and legality of your crypto transactions.

- Financial solidity: A stable bank signals dependability, suggesting your digital assets will be managed with integrity and expertise.

Remember, aligning with the right bank serves as a catalyst for navigating the crypto landscape effectively while maintaining peace of mind regarding the security and growth of your digital investments.

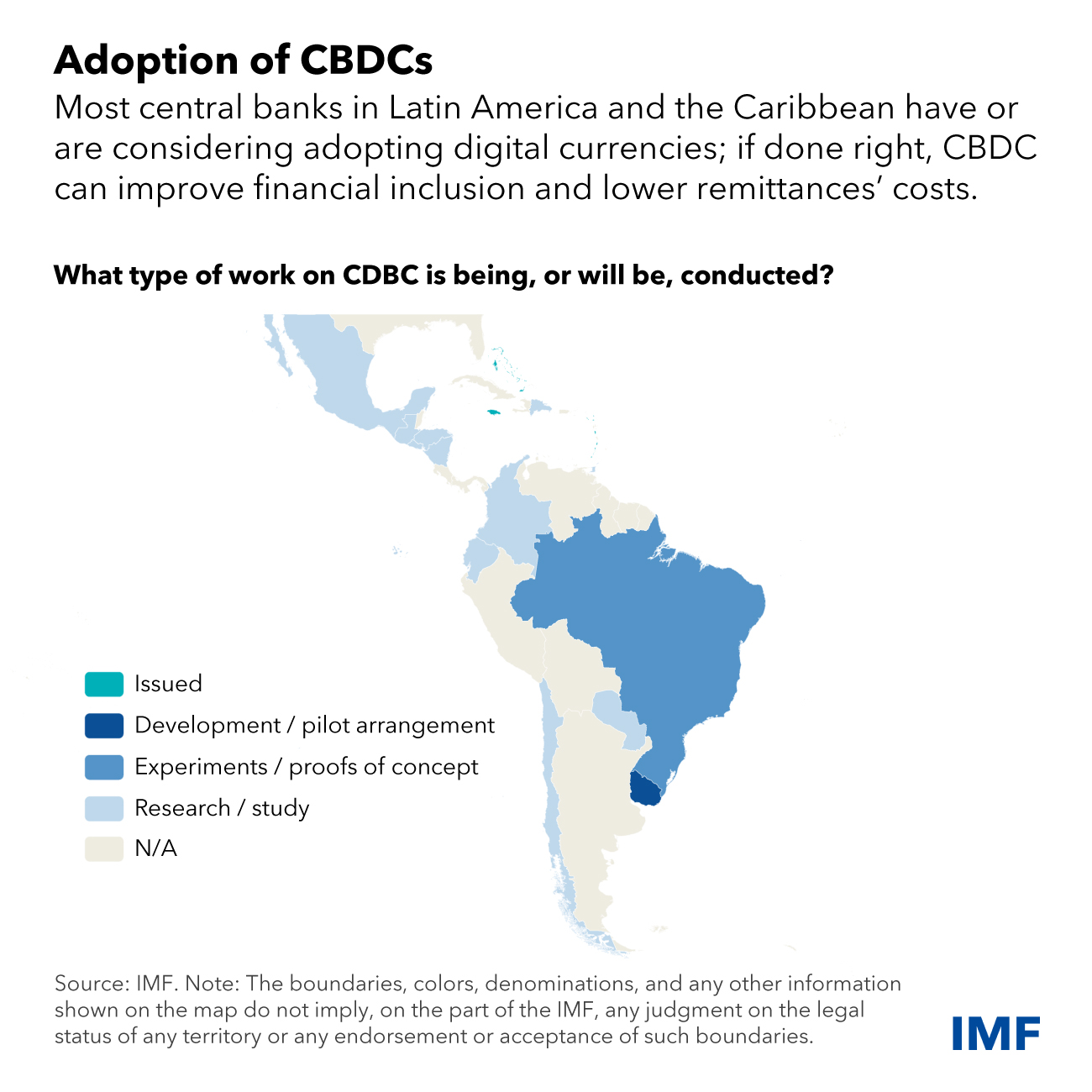

Credit: www.imf.org

Frequently Asked Questions On U.S. Banks That Accept Cryptocurrency

Which U.S. Bank Supports Crypto?

Several U. S. banks support cryptocurrency, including USAA and Signature Bank, which offer crypto-friendly services to their customers. Always check the latest information as the banking landscape for crypto can change rapidly.

Which Bank Supports Cryptocurrency?

Various banks support cryptocurrency-related services globally. In the U. S., banks like Silvergate Bank and Signature Bank offer crypto-friendly services. Major global players like J. P. Morgan have also started to embrace blockchain technology for payment systems. Always verify with your bank for their current crypto policies.

Does Wells Fargo Accept Cryptocurrency?

As of now, Wells Fargo does not directly accept cryptocurrency for transactions. Clients must convert digital currencies to fiat money through external processes before banking.

Does Bank Of America Accept Cryptocurrency?

As of my knowledge cutoff in early 2023, Bank of America does not directly accept cryptocurrency as a form of payment or deposit.

Conclusion

Navigating the ever-evolving landscape of banking and cryptocurrency can be daunting. The U. S. Banks embracing this digital currency movement are at the forefront of innovation. By choosing a forward-thinking institution, you’re stepping confidently into a future where finance and technology converge.

Remember to consider security, convenience, and regulation as you take this exciting step forward with your banking needs.