Apple Inc. Stock (AAPL) is a key player in fintech discussions on FintechZoom. The stock symbol AAPL represents Apple’s presence in the financial technology news space.

Apple Inc. Remains a dominant force in the technology sector, with its stock, AAPL, frequently making headlines on financial platforms like FintechZoom. Investors and analysts closely monitor AAPL for its influence on financial markets and technological innovation. FintechZoom offers updated news, analysis, and stock performance information, proving essential for those tracking fintech trends and investment opportunities.

Apple’s ventures into digital wallets, mobile payments, and other fintech services contribute to the company’s relevance in the discussion, reflecting its commitment to expansion in this rapidly growing industry. The integration of Apple’s products with financial systems highlights the company’s strategic moves to capitalize on fintech’s potential.

Apple’s Road To Financial Stardom

Apple Inc. has become synonymous with innovation and technology leadership. This journey from a humble garage to global domination in the tech sector is a tale of vision, persistence, and financial prowess. With each product launch and market move, Apple’s stock reflects the company’s growing influence in the fintech space.

From Garage To Tech Giant

In the 1970s, Apple began as a dream in a small garage in California. Founders Steve Jobs and Steve Wozniak worked tirelessly to develop the first Apple computer. This dedication set the stage for a revolution in personal computing.

- 1976: Apple was founded.

- 1977: Introduction of Apple II.

- 1980: Apple goes public, creating millionaires overnight.

Key Milestones In Apple’s Stock History

Apple’s ascent in the financial world is marked by key events that shaped not just the company, but also the tech industry.

| Year | Event | Stock Impact |

|---|---|---|

| 1984 | Launch of Macintosh | Boost in investor confidence |

| 2001 | Introduction of iPod | Signaled entry into consumer electronics |

| 2007 | Introduction of iPhone | Redefinition of smartphone industry |

| 2010 | Release of iPad | Redefinition of the smartphone industry |

| 2020 | Stock Split (4-for-1) | Made shares more accessible |

Each milestone not only fueled innovations but also galvanized Apple’s financial growth, solidifying its position as a tech powerhouse.

Fintechzoom And Financial Analysis

Navigating the stock market requires timely information and insightful analysis. Fintechzoom stands out in this regard, providing real-time updates and comprehensive financial analysis to both novice and expert investors. Whether interested in Apple stock or the broader tech industry, Fintechzoom’s detailed reporting equips users with the essential knowledge to make informed decisions.

The Role Of Financial News Websites

In the digital era, financial news websites are critical for market participants. They present up-to-the-minute market data, analysis, and expert opinions on stock movements. Investors rely on these platforms to stay ahead in the fast-paced financial world.

- Market Trends: Sites provide insights into the latest market trends.

- Stock Analysis: Experts dissect stock performance and future forecasts.

- Investment Strategies: Readers learn different approaches to investing.

How Fintechzoom Reports On Stocks

Fintechzoom takes a dynamic approach to reporting on stocks like Apple. Through detailed analytics, the site offers a granular look at company performance and stock health.

- Earnings reports and financial statements review

- Impact analysis of market news

- Technical analysis with charts and figures

The platform’s expert writers and analysts provide key takeaways from complex financial data. This allows readers to grasp the core information quickly and act accordingly.

Current Landscape Of Apple Stock

Exploring the dynamic world of stock markets reveals Apple as a standout performer. Constantly watched by investors worldwide, Apple’s stock shakes the financial platforms with its updates. Let’s delve into the current state of Apple stock, detailing its performance indicators and market emotion.

Recent Performance Indicators

Apple stock showcases a story of resilience and growth. Key performance metrics underline its journey in the stock market. The figures include:

- Earnings Per Share (EPS): Reflects profitability and growth potential.

- Price-to-Earnings (P/E) Ratio: Offers insight into market valuation.

- Revenue Trends: Highlights the company’s sales performance.

- Dividend Yield: Indicates the income investors can expect.

Data tables track quarterly results and growth trajectories. This information aids investors in making informed decisions.

Market Sentiment And Investor Confidence

Apple’s stock thrives on positive market sentiment. Investor confidence is a direct contributor to its valuation. Factors influencing investor sentiment include:

| Indicator | Impact on Confidence |

|---|---|

| Innovation Pipeline | Builds trust in inconsistent performance. |

| Brand Loyalty | Builds trust in consistent performance. |

| Global Reach | Ensures diversified and sustained revenue. |

Analyzing social media buzz, news coverage, and investor forums offers a pulse on sentiment. Positive news boosts confidence, while challenges test investor resolve.

Factors Driving Apple’s Stock Value

Understanding what fuels Apple’s stock value is key for investors. Let’s dive into the core factors that make Apple a standout in the stock market.

Innovative Product Launches

Apple stands out with its groundbreaking products. Each launch event is a spectacle that captivates consumers. The innovation behind these products sustains Apple’s growth. It’s not just about new models but revolutionizing technology. From the first iPhone to the latest Apple Silicon chips, these launches propel the stock upward.

Apple’s Ecosystem And Consumer Loyalty

The Apple ecosystem creates a seamless user experience. Once you buy an Apple product, you’re drawn into a world that works perfectly together. This integration retains consumers and prompts further purchases. Apple’s brand loyalty is unmatched, thanks to its ecosystem. This loyalty is a driving force for repeat business and a stable stock.

| Factor | Description | Impact on Stock |

|---|---|---|

| Innovative Products | Launches that set industry standards | Raises consumer interest and sales |

| Ecosystem Loyalty | Integration across devices and services | Encourages ongoing consumer investment |

- Regular software updates keep devices current

- Exclusive services like Apple Music add value

- Apple’s privacy focus builds trust

Analysts’ Take On Apple’s Trajectory

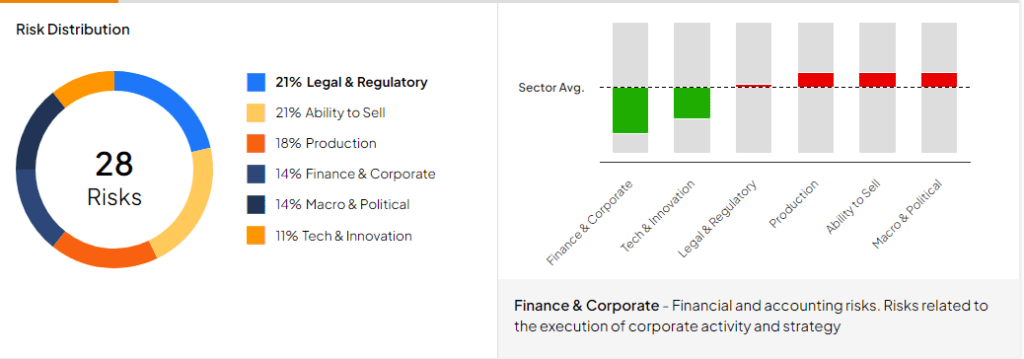

Apple Inc. remains a highlight in the stock market. Experts dissect the tech giant’s performance. They unveil potential growth paths and risks. Investors watch closely as market conditions evolve. Understanding these insights is crucial.

Bull And Bear Cases Outlined

Apple’s stock draws attention and sparks debate among analysts.

- The Bull Case: Optimists bet on Apple’s innovative edge, brand loyalty, and strong financials. They see promise in Apple’s expansion into new markets and services. Their view rests on a robust ecosystem locking users in.

- The Bear Case: Skeptics point to market saturation and fierce competition. They also highlight the threats of economic downturns affecting consumer spending. Regulatory pressure and legal battles pose further concerns.

Potential Catalysts For Surge Or Plunge

Investors keep a keen eye on factors that could shift Apple’s stock value. The stock market is a live game of chess. Moves can stem from various triggers. The right event can cause Apple’s shares to soar or plummet. Knowing potential catalysts helps investors strategize. Let’s explore what could tilt the scales for Apple’s stock.

Upcoming Apple Events And Announcements

Apple’s calendar is dotted with events that can sway its stock. Product launches, for example, often attract investor attention. An intriguing new device can boost confidence in Apple’s innovation. It can lead to a surge in stock prices. Below are the types of events to watch:

- Apple Keynotes – Major reveals, often causing market excitement

- Earnings Calls – Where financial health gets the spotlight

- Developer Conferences – Software updates can hint at new hardware

- Special Events – Sometimes, surprise announcements create buzz

Economic Indicators Affecting Tech Stocks

Economic trends have a big say in tech stock performances. Indicators like GDP growth, inflation rates, and job data inform investor confidence. For Apple, a strong economy often means more device sales. A weak one suggests caution. Here’s a table of key indicators and their potential impact:

| Economic Indicator | Positive Impact | Negative Impact |

|---|---|---|

| GDP Growth | Can lead to higher stock prices | Slow growth can scare investors |

| Inflation Rates | Moderate inflation might not deter buyers | High inflation can limit consumer spending |

| Employment Data | More jobs may mean more disposable income | High unemployment can reduce consumer spending |

Apple’s financial agility can withstand many economic changes. Yet, it’s not immune to macroeconomic winds. Tech investors stay updated on economic health for this very reason.

Investor Strategies For Apple Stocks

Investing in Apple stocks has become popular. Smart strategies are key. Learn how to maximize gains while managing risk.

Diversification And Position Sizing

Diversification is investing in various assets. It spreads risk. Position sizing means not putting too much money in one stock.

- Spread investments across sectors.

- Allocate only a part of your portfolio to Apple stocks.

- Balance your portfolio with other investments.

Timing The Market: Risks Versus Rewards

Many try to time the market. They buy low and sell high. But timing the market is tricky. It involves risks.

| Risks | Rewards |

|---|---|

| Missing out on gains | Buying at lower prices |

| Increased stress | Selling at profit peaks |

For long-term growth, focus on Apple’s performance. Avoid the rush to time the market.

The Future Of Apple In The Stock Market

The future of Apple Inc. in the finance world remains a hot topic. FintechZoom reveals Apple’s stock as a beacon of innovation and growth. Investors and analysts watch the tech giant closely. Apple continuously shapes the future through cutting-edge technology and market expansion. With a history of consistent growth, Apple’s long-term stock projections look promising for shareholder value. Let’s delve deeper into what the future may hold for Apple in the stock market.

Technological Innovation And Market Expansion

Apple’s commitment to technological advancement defines its market position. The introduction of new products keeps the brand relevant. Advanced features in iPhones, iPads, and MacBooks keep consumers excited. The foray into services like Apple TV+ and Apple Arcade diversifies Apple’s revenue streams. The expansion into new territories, such as health technology with Apple Watch, underscores their market dominance potential.

- Continuous R&D investment

- Revolution in consumer electronics

- Diversification into digital services

- Expansion in the health sector

Apple’s innovations lead to an expanded consumer base and greater market reach. These factors could propel Apple’s stock forward.

Long-term Projections And Shareholder Value

Long-term investors treasure Apple’s stock. The company’s robust ecosystem creates a steady revenue flow. Analysts predict a bullish outlook for Apple’s financial future. Apple’s stock buyback program and increasing dividends are testaments to their shareholder commitment. The potential for stock split increases accessibility and demand among small investors. All these activities enhance shareholder value.

| Year | Revenue | Dividends | Stock Price |

|---|---|---|---|

| 2023 | Positive Outlook | Upward Trend | Potential Growth |

| 2024 | Stable Projections | Consistent Payout | Continued Expansion |

| 2025 | Innovation Driven | Increased Dividends | Investor Confidence |

Apple’s strategic maneuvers in research, market expansion, and shareholder policies could define a new era for the stock market. Despite market fluctuations, the resilience and adaptability of Apple make it a promising investment choice. Its dedication to innovation and value creation could make Apple a shining star in the financial sky for years to come.

Frequently Asked Questions On Apple Stock Fintechzoom

Is Apple’s Stock A Good Investment Now?

Investing in Apple stock can be a good choice due to its consistent growth and innovation. However, market conditions and individual financial goals should guide your decision. Consulting a financial advisor is recommended.

What Is The Latest Trend For Apple Stock?

Apple stock trends can be tracked through financial news on platforms like Fintechzoom. Currently, it may be showing steady growth or fluctuations based on market reports and economic indicators.

How Does Fintechzoom Analyze Apple Stock?

Fintechzoom analyzes Apple stock using various metrics such as earnings reports, market performance, and industry comparisons. They provide expert insights and updates on stock movements to inform investors.

Can I Buy Apple Stock Through Fintechzoom?

Fintechzoom does not directly offer stock purchasing; it’s a platform for financial news and analysis. To buy Apple stock, use a brokerage account or financial service provider.

Conclusion

Navigating the complexities of Apple’s stock market presence requires insight. Our exploration through Fintechzoom has offered key perspectives. Armed with this knowledge, investors are better positioned to make informed decisions. Remember, market vigilance and strategic planning are your stalwarts in the ever-evolving financial landscape.

Stay updated, stay ahead.